Preface

Even to

the professional traders, they can’t tell the Stop loss point from the lowest

point

The

Lowest point, eager to

know, is necessary condition for the loss cut and reversely ,the loss cut is

sufficient condition for lowest point, since traders can’t always success the

lose cut in spite of knowing the lowest point.

Hence

the aim for study of the technical analysis chart is not rather for knowing the

lowest point but than for managing the idea of imagination or visualization of

“the loss cut”.

Without

knowing any criterion or strategic of this, we are predestined to be fail

and any further step such as the retrospection of mind control will be like “put

the cart before the horse” Because Stop loses is another matter of lowest point

which is ceaselessly intermitted and interrupted and disturbance by the

psychological trauma issues as well as money management.

The

rest of further step which is consequently remained only the matter of the

response, the response according as situation of capricious candle point will be

retrospection by dried reason,Since we have been countlessly betrayed and

disappointed by lowest point.

The

royal road to conquer the trading Forex/stock is synchronizing three

master-intersection fields; chart analyzing, controlling psychology and money

management. The Most troublesome field is the chart analyzing.

For the

professional trader, snapshot on time, our target should be predominantly to

melt and to synchronize another three sub-intersection; ‘C wave point, Bollinger

Bands and stochastic indictors, to naked the lowest point in this book excluding

thoroughly lucky guess

The

chart , even to the professional traders, had unwelcome presented so many hard

times, suffering and uneasiness, to decipher the lowest point which will be

revealed by the chapters 3~8, having confidence in that when we know this point,

we may be well armed with fearless kits against the fear.

The

rest of them will be issue for psychology at chapter 9, (Knowing Oneself in

technical Analysis) and will be subject for the Management: at chapter 10(A Game

like Backgammon) and will be issue professional morality at chapter 11, Ethic in

chart. Hence the book is sectionalized by master three parts and by sub-content

three sectors

We

modestly grant that the prediction is God’s territory but not human being. We

are only allowed to access here as imagination and response as necessary

condition of lowest point.

The

loot of ‘Prediction’ is itself confessing as pre (before) + diction (tell)

before you tell something, we have to primordially possess some “idea,

imagination or visualization” for responding a moving target. The ability in this kind of

job seems such a small difference but essentially big difference since the

ability is almost a synonym of knowing the LOSS CUT or STOP LOSS.

Without the idea or imagination, we would better be eye’s shoppers,

shopping for only eyes like in department store but never open a wallet for any

items and click it.

I will

chiefly attempt for the naked that lowest point with my survival kits; two tools

intersected by Bollinger bands and stochastic and a conception of the Elliott’s

‘C wave point “but from time to time

I will

not exclude the collaboration not only from the ancestral heritage such as:

classical 17 trend patterns for drawing resistance and supporting lines,(all 7

factors) but also those typical and traditional three main indicator; candle,

MA and volume in the light of human psychology and also will try to not stingy

about the explications of the lowest point where social science is started and

where is ended by social science

but I

will less ‘stop loss’ as possible, and I will less abuse the panacea for excuse

of “stop loss” We shall proceed (but my reader! Never do entry unless or

otherwise without knowing of stop loss) we must carries those tools in war as

essential weapon before going to the

battle.

In fact

I have long felt that our usual methods for technical analysis, falling along

separate longitudinal sections — Bollinger bands, stochastic moving averages,

candles, Elliott wave, traditional patterns, (except money management, states of

mind, professional ethics, as well as the histories from

technical charts) –

do not do justice to the unity of real trading for the purposes of

creating money in the technical analysis, even all indicator, should be written

collaterally as well as linearly, synthetically as well as analytically on one

chart, all for one.

Subsequently It is true that the specific information about indicators are

insufficient for novices and

it is natural that required essentially for supplementary reading:

Elliott wave, Bollinger bands, stochastic, Moving Average and candle chart as

basic course. I will not parsimonious about disclosing to unique methodology and

only issuable information which you can’t get from internet recourse.

but for the professional traders who knew what is the those indicator

and more than 10 year experience do not necessary to supplementary reading but

they are required to be majestically a peeping Tom how I am handing it.

There

may be good cause for caution in forming such a view even technical analysis

field as expression of chart language: The probability of error increases with

the scope of the undertaking, and any analyst who promises a synthesis of

indicator fields into one chart, all for one, may become a tragic target for the

myriad of darts that experts can deliver in their critiques. Though I will dare

to venture to display all the fear and greedy by means of those limited 7

components in my chart language

Nevertheless those 7 key factors will be brutally pugnacious to

professional traders as well as novice; skipped all the general information and

even concisely compressed all the composite of elements, it may be hopefully

good excuse that I haven’t solved problem of my bizarre chart alignment which is

totally newcomers as originality Hence I put “the Instruction chapter”

beforehand those 7 keys of my chart tools.

To

begin this investigation of technical analysis, I offer what we may call

“reports,” “On-air, live and from the scene,” through which I describe actual

processes in trading – tales of battle and adventures that convince anyone who

believes in the motto “seeing is believing.”

Nevertheless, the knowledge that investors and analysts have

accumulated, had been divided into two areas: actual trading for the creation of

money, a set of highly specialized processes affecting the supply and demand,

especially in timing, so called technical anlysist; and the candle is

eventually converged

into it’s internal value, so called fundamental anlysist, Both

of these fields have refrained from attempting any view of the whole process of

the creation of yields — whether it be a view of indicators or of presumable

candles; whether to predict their next movement or the effects of

psychological mutation

from greed and fear.

From

that point, we explore the issues confronting each investor: the complexity of a

candle’s movement from the perspective of psychology, in real-time; greed and

fear; resistance and supporting lines. Throughout all, I hold the view that “to

be practiced a shortcut to learning or even better to be majestically peeping

Tom how I am trading in toilet sneaky”

First(unless

introduction charpder is first one )

chapter will be opened the results of my bank account how is fluctuated, luring

as “On Air, Live from the Scene” to the Tom, peeping in my toilet.

Thus It

may be very unfriendly to general users (novices) but professional traders who

has experience at least 10 years, will catch the point “how come?” and “with

what tools,” this guy is catching the fish! Hence the process of the curiosity

will be deductively narrative as 7 survival factors.

How we

are exposed, scared before money, and assailed by thousands of fear and greedy

before money in trading according as candle’s dance. Since trading is 70%

psychology, rest of them, technical issue.

In

first chapter If you don’t know any lines on chart language, never mind, you

will be gradually intimacy what is and how to read it. This is my final goal to

be reached at though this progress in introduction chart.

But I

am strongly insisting on that you must see first the account how is increasing.

Tempting enough let us eager to listen what chart is telling us, and examined

the lowest point well and truly, if not, let us turn away from my chart language

unless the reason and logic has failed to guide and persuade you there.

I want

my readers to share this horrible fear with my chart. It will be huge advance in

this field, if someone feels tragedy drama from chart; I think not less than 5 %

of trades can feel how candle is sung and dance. hence I adapt “on air ,live scene,

how I strife for survivable , from the chart , feeling the uneasy, suffer or agony , it is

almost near to goals, thou, chart language is too difficult to decipher , if you

feel it, it means you understand and listen to what chart is telling to you

about good and bad news.

Perhaps

this is best way for readers to lick my brain and heard my heart beating

throughout live show of battle (I name on it as air live scene from the

battle) This may work,

yes, as a narrative in the first chapter partly, and rest of them, Continued

last chapter. If you don’t want to disconnect the story, you can directly skip

to chapter 13

However

I haven’t invented any of tools ,except my PMA, on my chart formation but found

out what is more like

chemically and statically optimal combination from exposed indicators

under sun, as well as what is for enhancing the possibility of candle movement.

Rather

it looks like irresistible ice-creams. It seems no room for new invention like

‘reinventing wheel’ which has been existed already like my indicators on my

chart, rather what I did, is how to make it only the delicious or irresistible

ice cream since it is secretly matter of chemical combination from composited

materials such as water, sugar or chocolate, which has been already existed.

in this

time I am unwilling to tell you what is water, origin , what is an ingredient of

sugar and what is imported tax on chocolate, rather willing to tell you how to

composite chemically all better possibility, related number and factor for

forging the irresistible ice-creams, Of course for creation of money.

Similarly I am using Bollinger Band, stochastic, MA and C wave, for

the confluence of intersection factors to know loss cut, which has been existed

before me as a famous tools, but not as correlation Numbers to produce not for

the delicious ice-cream but for the earning the money (if you don’t like this

expression let us say “not losing money”) From now on, you may be part timely

‘Peeping Tom’ sees the chart No

<s>43~60</s>, and then you will see this

is real time live show from my chart and account as proof of the loss cut.

The

currency market is much like war, but the fighting is conducted by our proxies,

traders with civilized weapons. As soon as one sits down in a trading room with

keyboard and mouse, one confronts an anonymous enemy who is Faceless, nameless,

and nationless, but who, with one mouse click, accesses the vast arsenal of

e-trading even in toilet. The currency war occurs every day, with a trade volume

of USD 3 trillion.

As we

view currency trading as a kind of war, we can see that the enterprise fits well

into the whole structure and history of civilization. As the Greek philosopher

Heraclitus once said, “War is father of all things.” Such war does not happen

only on battlefields, but takes place even amid the civility of the modern

world, everywhere and at all times in a variety of forms.

In the

currency war, battles are fought between the bulls and the bears,(remember why

we call trading terms as “the bullish and bearish phase”) strife is between greed and

fear. Ultimately, like all wars, it is being fought for the preservation of the

civilization that wages it, for the sake of reproduction and survival.

Thus,

we are marching to win a war, so that we can continue in the trade of life and

in a life of trade. The tools I present – a survival kit for this war – may seem

complex and odd at times. They are probably not suitable for all traders.

It has

often been said that we can achieve this if we know how to control our fear and

greed. However, such a goal is not realistic. Not even the most respected of

analysts could achieve it, as the lives and work of Joseph E. Granville, Jesse

Livermore, or Ralph Nelson Elliott attest.

Secondly, you may not be happy the process of trading, no matter

what, from such as scalping, intraday trading, middle term trading or long term

trading, rather it is the process of your life is unhealthy and dried life and

you may be eventually living on the heavy stress, and Even entirely you isolated

life from community. So many people will agree on that this is not good life

Also I

believe that this is far from wellbeing life but it is busy for producing for

just lonely warrior

Finally

the rest of 95%, losers from this game, we are meant to pave to Bible’s

prediction “He who lives not by the stock shall not die by stock/Forex”

Accordingly my scope of guidance will not be completely happy (even though 5%

winner, survivors)

In

fact, after result, we can make a voice thousand times as different shape for

justifying but before result, we cannot even one voice for the tomorrow price.

We call

it only God knows and nobody know tomorrow price. Even if I do ornament on my

chart about lowest price, I do not really know, only God know and can predict

tomorrow price.

If

someone telling you that he knows tomorrow price, remind them of “power of

compound interested ratio, if he knows it, amassed money like snowball and dying

of too much money” and finally destroyed market run.

You may

ask me what purpose you need to study for this book.

Answer

will be for “responding as circumstance” since it is not territory of prediction

but response

Then

you doubt it again and ask me again

“

Is it

useless as chess game”?

Unless

you are inevitable, have your own ‘principle’ or criterion and access with ‘idea

or imagination of its next step from chart’ and execute “stop loss” you may be

far from what you pine for. Hence Keep away from prediction such as stock,

commodity and Forex.

It

would to be unspeakably delightful if I get pardon from my readers not only for

my poor language but also for handicaps of uncovered cultural gap, programed by

Korean soil and soul, in the way of thinking and expressing, since the English

is unassailable enemy to me.

Odyssey Lee

In searching for STOP LOSS point

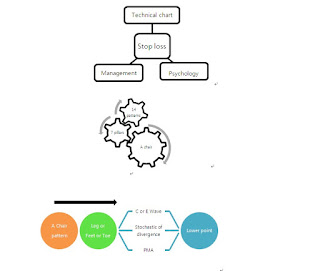

The first one; the technical chart is our master subject, and

the rest of three directories; Psychology in trading, Money Management, as well

as Chart in ethic will be coordinated not so much for directed influence from

technical analysis as in-directed influence from subordination of chapters; 9,

10, and 11.

we will try to navigate synchronous those three sub- subjects (3 balls) on 3 miller’s conditions, by tools of Trio indicators, for we will try not so much to dig up its internal value of the bottom price as to naked it’s timing as general as chart anlysist

we will try to navigate synchronous those three sub- subjects (3 balls) on 3 miller’s conditions, by tools of Trio indicators, for we will try not so much to dig up its internal value of the bottom price as to naked it’s timing as general as chart anlysist

Summary of layman terms

In the

expression of Diagram, it will be whole concept for your

brainstorming

For example the process will be combined with

Ø one of master subject

,Technical chart analysis

Ø one of sub- subject, A

Chair pattern

Ø one of sub-sub

-subject 3 miller’s

conditions,

If you successfully synchronize the second step of

sub-subject,

you may finally well reach at the process of 3 miller’s

conditions with Trio indicators.

Its uses not only were so varied but also were reliable signals, and I would be always propitiated from them.

Meanwhile

It has always been an endless game to chase the lowest

point; it is a challenge to build on the work of the pioneers who came before

us.

In this method, which is a new combination of previously

established methods, the path to the lowest point lies in three directions; the

“chair pattern” modified by my "3 Miller traditional trend lines (14) pattern”,

and the “Resistance & supporting lines (7pillars)”,

and is supposed to be indicated by the “three Miller conditions” Rather than depend on any single of these measures, statistically speaking, it is advantageous to seek the optimal stoichiometry of all three.

and is supposed to be indicated by the “three Miller conditions” Rather than depend on any single of these measures, statistically speaking, it is advantageous to seek the optimal stoichiometry of all three.

However, this does not constitute a 100% guarantee, but a

much better-than-odds certainty. Remember there are no necessary conditions for

lowest point but only sufficient

conditions.

Even for professional traders, it is seldom distinguish the

Stop-Loss point from the lowest point of a given graph series.

The Lowest Point, we should be glad to know, is a necessary condition for the Loss Cut Point and conversely, the Loss Cut Point is a sufficient condition for the Lowest Point, since traders can’t always succeed at the loss cut, in spite of knowing the lowest point.

Hence the aim for study of the technical analysis chart is

not rather for knowing the lowest point but rather of managing the idea or

visualization of “the loss cut”. Without knowing any criterion or strategy such

as this, we are predestined fail and any further steps such as the retrospection

of mind control would be putting the cart before the horse.

Because Stop Loss is also related to the lowest point it is

unmitigatingly disturbed by psychological trauma issues as well as money

management issues. (From the part of preface)

Bon

Voyage!

-End of Summary of layman terms-

Volume I

Instruction

of Our traditional heritage

Chapter 1

Resistance & supporting lines

with (7) pillars

Our terminus in studying chart is the bottom of price

candle, shown as above, but we rarely convinced for those point whether if it is

real McCoy or not.

I will attempt to create several resistance supported lines

on that original with selected 7 pillars and of course, it can be re-checked and

can be detective by my 3 millers with intersected conditions of 3

directions.

I am highly yearning that it is not a fruitless attempt to

ensure the better probability

My task is to guide your entire intention for focusing all

energy on those retracement waves, nothing but that corrective wave such as A,

especially in C or E wave.

It must be intersected by one of 7 pillars

requirement, shown as the above diagram, intersected by

my (7) pillars as bellows pattern, which should be one of three directions.

However in any sense of

simplicity, your brainstorming of key diagram

will be processed as bellow

of combination.

Finding out the bulls eye, we rectify 7 pillars by filtering

my 3 millers. The routine with same process as above in each combination will be

our final destination in this

book

“Not to find out the Resistance & supporting lines from

the chart is not to create the statistic from market” that is all, nothing can

be better expressed but this is main reason why you have to allot time to study

of 7 pillars.

But in actual trading the finding out it is not often

enough to ensure

It will be double defense, finding out those 7 pillars, that

you may enhance the probability, adapting it several diverse time frame charts

rather than just one chart. it makes you comforted, and reliable ,for example if

you find out one of those pillar in daily chart, instantly transmit it into 60

minute, weekly or monthly timeframe chart and synthetically look around as

means of Kant bee.

Personally in my timeframe, I endeavor to obtain first

signal in daily chart as means of chair pattern, and apply those reason into 7

pillars subordinated chart such as 5 or 30 minute chart. It is high probable way

to enhance the possibility from those 7 pillars.

Above subject will be satisfied with 3 miller’s necessary condition of bull’s

eye mark shown as bellow

In sense of structural convenience, I would like to approach here with different angle of conception from the Resistance & supporting line, where meant to be one of sufficient condition of the retracement wave.

It is bull’s eyes, the lowest point, where we shoot on not

with arrow but with logic &

reason.

We can access the lowest point not only from my chair

patterns with my 3 millers but also from the conception of 7 factors (I name on

7 pillars) of Resistance & supporting lines,

because my methodology for the lowest points skills should

be overlapped by one of 7 factors of Resistance & supporting such as:

Fibonacci line, Gaps of candle, Previous high &low price, Psychological

price, Bollinger Bands Moving average, as well as Typical Trend lines &

patterns.

Meanwhile this chapters of “7 pillars” and “Typical Trend lines & patterns” is doubly intersected in common with traditional trend line patterns since Dow Jons which should not rudely ignore, as our heritage of technical chart analysis skill, due to the proof of survivals thorough natural selection Such as: Ladder pattern Wedge patters, Triangles, Flag pattern, Moving average (MA) Converged to power with 3 MAs.

I have assiduously grubbed all the facts where converged into the lowest point; for I have

strongly believed that this is matter of quantity game for assembling our

heritage to enhance the better statistic ; such as 14 trend lines and 7 pillars

for 3 millers condition and to ensure the highest probability from the

precarious fortunes of the

chase.

At any rate

Those 7 pillars have been our heritage in technical analysis field. It is proved year by year and generation by generation and survived by the process of “natural selection” in any sense of a last stander.

Those 7 pillars have been our heritage in technical analysis field. It is proved year by year and generation by generation and survived by the process of “natural selection” in any sense of a last stander.

You may well give them some credit, but not too much for all

your credit to those 7 pillars and you may well share your predilection with

correlated facts for Stop loss.

I wish you to regard it as a means of

tracing one of lowest methodology. Don’t be too

naive too trust them all.

When it is interested with other fact, let us not ignore as

just passing a dog on the street from windrow of your life but pay to curious

attention with my

trio indicators.

Meanwhile it suddenly has been occur on me that perhaps it

was not so much matter of finding just those patterns, as matter of chemical

combining with that element of facts,

Or as perhaps simultaneity comparing with other chart from

diverse timeframe.

Or as in all essential aspects as

Kant bee[1],

for it was not so much required the brain power for interpretation as comported

with Greedy and fear in retrospection.

Or perhaps it is by

far the most important step for eventually synchronizing

all the factors, on

a larger scale targeting for stop loss

This is my grotesque chart formation, programed to be

unfriendly but to be ensure high possibility. It is shown Elliott wave.

We are going to dissolve the inside of the circle (2 wave)

which is our bulls eyes where there are the Confluence of as all 7 pillars

resistances and supported line, not to speak of other two

balls.

We will repeatedly and persistently try to shoot and shoot

aging it, dissecting in side of circle until it became to be intimate with ours

eyes. It may not be unproductive effort for our journey at all.

“What you can see it” is synonym of “what you get it” or

“you can see as much as you see”

We will diagnosis those bottoms of retracement and bottom of fear (the corrective wave) with my 3 millers after punctiliously zoom in/out, on large scale, this ambushing place.

We will diagnosis those bottoms of retracement and bottom of fear (the corrective wave) with my 3 millers after punctiliously zoom in/out, on large scale, this ambushing place.

I highly expect that you will be gradually intimated from a

sort of xenophobia of my chart

formation.

It is part of previous chart, where is zoomed in those parts.

Let us see the inside world of my grotesque chart what is

going on, zooming in/out, details drama inside of circle. It come to us

clear enough to be diagnosis with my tools.

In fact it is displayed all the 7 pillars, I know, it is

obscure lines enough to suffocate your breathe and brain. It is still Greek to

us.

Can you find out where are confluence 7 pillar of in this

chart

Yes See ④ and ⑤!

scrutinize those points since it is my hunting place but ⑦ and ⑧ I will narrate later in stochastic chapter in my trio indicators[1]

Anyway

Have you looked your circumstance back where we are in the

light of Macro view?

And have you feel some sensation for synchronizing the fact?

Yes! See ④ and ⑤ circle marked, red color marked, zooming in/out, Using the scroll

bar function so as to zoom in and

out.

Those two points are the Eldorado where has been gold mine

and been in lowers point within 1 month period, retracement and eventually where

we are heading for The point where are insinuating and luring our attention as 7

pillars, resistances and supported

lines.

Dissolving of that point into its element is the aim of this

chapter.

Meanwhile You may notice that background color both blue and

white which is my personal program to obtain automatically the bullish phase

(blue) and bearish phase (white background).

In side of this wave you can hunt the lowest point.

Regardless of size of wave, I will take place to hunt only in the retracement

wave.

Remember always about your stance where we are, thinking as

a big as you can, comparing related timeframe chart as possible as you

can,

and trying to see whole forest but not a tree as often as you can. I will tell you soon how to achieve such a sensation of navigation, from MA and the wave.

and trying to see whole forest but not a tree as often as you can. I will tell you soon how to achieve such a sensation of navigation, from MA and the wave.

In all essential aspects,

Ask yourself why the point could be some significant and

infatuated by professional eyes?Because it has reasons and is intersected

and concurrent by 7 pillars.

If you have same eyes as professional eyes, it may be beneficial for we voyage as the magnetic like the North Star, a navigator,as long as we can synchronize 7 pillars with the professional eyes

If you have same eyes as professional eyes, it may be beneficial for we voyage as the magnetic like the North Star, a navigator,as long as we can synchronize 7 pillars with the professional eyes

1. Fibonacci line

2. Gaps

3. Previous high price

and low

4. Psychological price

5. Bollinger Bands

6. Trend line

7. Moving average (MA)

See ⑤ again, as well as it’s

vertical timeframe which are ⑦ and ⑧. From the this point of ⑤, the sooner had

you seen 7 pillars, than your wallet had been thicken and heavy, because it is

best ambushing place to hunt whenever BBS is opening as Dynamic stage, which is

one of 3 millers conditions.

Count on with your finger how many do you find out such

intersections of those 7

pillars?

And consider the PMA (Previous moving average refers to MA

chapter)?

I advise you to solve this question on papers, taking it

easy, slowly but surely

In this chart, can you find out where are all the 7 pillars

of them?

And can you be familiar with this chart, now?

You are inside of our main chart.

After “zooming in” I wish you to remember where you are now

and what stance we are, before shooting on the target

We shall proceed to find out those outside layer of target

point, Resistance & supporting lines with (7) pillars since the layer is one

of our ball to be digested before we reached at 3 millers conditions.

End of

instruction

[1] See the Ethic in

chart :Kant bee; an way of access to analyze the chart both inductive and

deductive logic especially approaching in whole chart or multi chart such as in

BBS, MA lines and patterns as synthetic judgment