Please

do not open it

it is

it is

on the construction

wait a minute !

thanks

thanks

Our

traditional heritage

Chapter 2

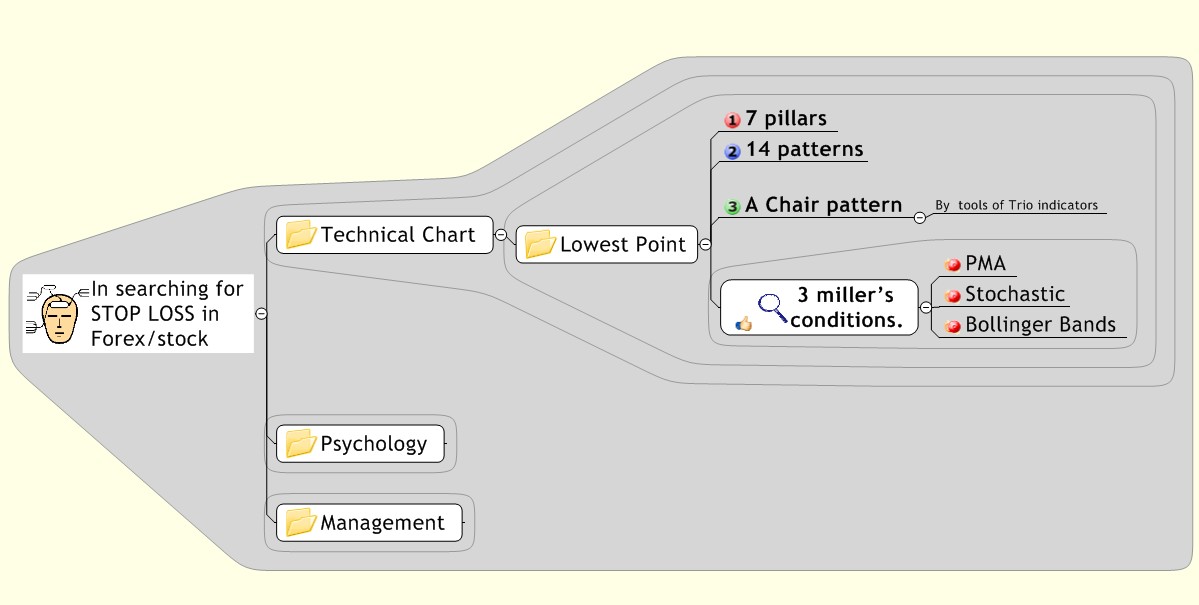

Traditional trend lines 14 patterns

The Road to the

lowest point has three directions (3 balls);

chair pattern which is hopefully best result in combination with resistance & supporting line with (7) pillars which is very unstable and traditional methodology of trend patterns, and which owe to be methodically respected the reputation of old generation skill.

chair pattern which is hopefully best result in combination with resistance & supporting line with (7) pillars which is very unstable and traditional methodology of trend patterns, and which owe to be methodically respected the reputation of old generation skill.

The lowest point

should be overlapped or must be intersect by one of three directions and all

must be detected by My 3 millers.

For enriching the statistic, we better to know the other two directions as well, doubtlessly the more possibility we handle, the more statistics value we obtain.

For enriching the statistic, we better to know the other two directions as well, doubtlessly the more possibility we handle, the more statistics value we obtain.

Hence

We shall

see those components of factors naked and fully naked

And

attempt to breakdown and rebuild Elliott theory in this chapter, juggling the

facts for the lowest point

Unconsciously

and frequently we may heard about special terms of double bottom, double deep, shoulder,

Golden cross and dead cross and from mass communication such as TV, Radio and newspapers.

Astonishingly Few peoples seldom know where come from and originated.

Astonishingly Few peoples seldom know where come from and originated.

The more

they know, the more they surprise that the below 14 terms can be welded or jointed

by Elliott wave.

So many professional traders seldom know those Traditional trend lines 14 patterns are bastards born by of

Elliott waves, even to the professional trader, surprising enough to die.

I do not know the reason why bother themselves to express

in those terms.

presumably, they did it for some convenience to easily transfer that idea into general peoples?

Anyway we shall see:

presumably, they did it for some convenience to easily transfer that idea into general peoples?

Anyway we shall see:

Symmetrical

triangle, Ascending triangle, Descending triangle patterns, Wedge, Rectangle,

Ladder (Channel), Flag Converted Flag pattern, Rounded bottom and Cup with

handle pattern W pattern, Double bottom W, V pattern and VVV pattern before we

access with my chair condition pattern with my 3 millers.

Subsequently these chapters will efficiently confluence with lowest point, intersected with other two chapters

I would

like to see and access to here from our traditional heritage of pattern, achieved

before us by precedents, our senior leader, and as the byproduct of toil and perspiration

since Dow Jons, the founder of technical analysis, and also would like naked about mediocre toolkit which has been survival from biological fittest “challenge and response” and from natural selection in this field,

for The existence itself is undirected verification of its value and Subsequently whenever those 14 patterns are faced and concurrent and with my 3 miller’s tools,

since Dow Jons, the founder of technical analysis, and also would like naked about mediocre toolkit which has been survival from biological fittest “challenge and response” and from natural selection in this field,

for The existence itself is undirected verification of its value and Subsequently whenever those 14 patterns are faced and concurrent and with my 3 miller’s tools,

we would better enhance

and eventually arm with high probability.

Those tools will be paraded the 14 traditional knowledge, in terms of my unique psychological interpretation.

Those tools will be paraded the 14 traditional knowledge, in terms of my unique psychological interpretation.

In Chart

world, the power of memory does not seem to be usefully effective as much as

Quiz show . but seems to be requiring more power of synthetically interpretation.

It is not because of a game based on the fragment of knowing but based on ability

for Communicate with the psychology from chart language into especially geometric

pattern since it is just habitual human behaviors repeat by itself, like human

history.

We have

to focus not so much memories all 14 pattern, as the study of their psychology situation,

for it is not matter of quantity of information, nor for quantity of knowledge,

but it is matter of power of comprehension of psychological communication. Otherwise we will be forlornly exposed to restless places where is blinded by fear and greedy where human logos is defenselessly disarmed with pathos of restless, and even vulnerably suppressed by emotional with unpredictable reactions, If we are not trained.

but it is matter of power of comprehension of psychological communication. Otherwise we will be forlornly exposed to restless places where is blinded by fear and greedy where human logos is defenselessly disarmed with pathos of restless, and even vulnerably suppressed by emotional with unpredictable reactions, If we are not trained.

In order to

not allow us in such a situation of pugnacious statue, we need to be avoided and

familiarize and intimated all possibility in dangerous situation, we will be

less frightened unless we can habitual a certain case of repeated pattern.

I have believed

that the most powerful tools are perhaps capability for deciphering the psychological

chart language and for enhancing the ability for converting the chart into

storytelling, and reversely re-converting from storytelling to chart.

Otherwise

we can’t construct any criterion. Watching on chart, if you are able to

reconstruct that fragment of pattern in the storytelling, we may no longer

novice. It must be meaningful advance to be near to hunting the lowest

place.

This

is layman terms of key conception how to process

At First

circle, you may find out the interesting point from one of Traditional trend

(14) pattern

At seconded

circle, in this case, you find out this symmetrical triangle pattern

At third

circle, you refinery the result by 3 miller conditions with Trio indicators

You may

combine and copy this process not only this symmetrical triangle patterns but

also all different (14) patterns with same routine way

Chapter 2

Symmetrical triangle pattern (1)

Of Studying

the pattern, it seems like studying geometry, summoning the soul of Euclid

(300? B.C.).For most of pattern is son of geometry shape

We begin with Symmetrical triangle pattern.

What a

perfect of Symmetrical triangle pattern it is!

It is splendid

beauty

See the

right side of chart.①②③④⑤⑥⑦⑧⑨ and ⑩.

And let

us ask ourselves with sophisticated a question since we have already had the

50% of prior language

if we can question properly and If can’t any question for something we know nothing. Anyway as long as we can choose good question, we solved the problem of 50%.

if we can question properly and If can’t any question for something we know nothing. Anyway as long as we can choose good question, we solved the problem of 50%.

First

one “Is it inevitability or an accident why do they display on shape of Symmetrical

Triangle with order from the chaotic chart?” if it is not a planned architect.

Second one “is there a gentleman agreement for drawing Symmetrical Triangle between traders?” even so, is it really possible to draw certain geometrical shape with the agreement on chart with those agreement?

I

hope

those question is 50% of all answer of this chapter

The less

of 50% answer will be

We would better regard Symmetrical triangle pattern as son of Elliott wave, converging to power by psychological strife of triangle (3.3.3.3.3.3.) pattern in the process of E wave

Moreover

we may well consider those contractions of power as the converging of 3Mas

But it

is often occurred at the point of C wave shown as (C) point which is (2/3) or 70% of whole triangle

(a)

has more possibility and stinking of which

direction is up or down, When it is breakthrough

within of two third (2/3) or 70% of triangle, usually it breakthrough upper /

down line as (a) in my personal experience

(b)

has converted

into vertex as (b), 100% all the patterns including triangle and ascending descending

and wedges pattern, has hardly get clue by means of its direction anyway regardless

of direction, it must be determined which way they are heading for approaching

to the apex

For example

of case (a)

in order to be breakthrough upper line as (a),

it should be happened to the point of ③ or ⑤, owing to breakthrough within of two third (2/3) or 70% of triangle pattern.

in order to be breakthrough upper line as (a),

it should be happened to the point of ③ or ⑤, owing to breakthrough within of two third (2/3) or 70% of triangle pattern.

case of (b),

we can hardly predict the direction, in this case.

we have wait until being converted into vertex as ⑨ or ⑩

we can hardly predict the direction, in this case.

we have wait until being converted into vertex as ⑨ or ⑩

However

Review numbers

②, ④, ⑧and ⑩.

I require

from you the capability of converting from chart to storytelling and convertibly

from storytelling to chart.

It is one of key for understanding pattern.

Such a small makes big difference in chart world and in this game of war, to death.

It is one of key for understanding pattern.

Such a small makes big difference in chart world and in this game of war, to death.

Ask to

yourself why those numbered line touched by price and are down? It is synonym

of that you know 50% of it If you can properly make question by yourself about

Why

And why,

though Price which is inanimate object is it drawing Symmetrical triangle like an

animate object, all trader are a geometrical or an architect?

And

review uneven numbers ①, ③, ⑦ and ⑨.

And again

ask yourself why?

Try to enhance

the power of introspection

And Is it collapsed nearby an apex of triangle?

Never try

to memorize just patter but to be understood it fully, with imagination what is

your chose, if you are in the positions, one of those points

If you

are approached to what you are doing now, it will small different but future it

big different so that your power of deciphering chart will be unlimited.

Anyway the

answer will be from next pattern

You may automatically

be understood after reading next.

Ascending triangle pattern (2)

It has same substance and same attribution of psychology as Symmetrical triangle pattern.and Only appearance of trend line is different in battle point of price level.

See the

even numbers ②,

④, ⑥, and ⑧ all the point of price is flat. Do not interpret even think it as a

sort of fluke or a chance. It is byproduct of psychological war to live.

On the

other hand it seems more likely Pessimist’s lines that they will happy for

selling at the same price of flat level, regretting about lost chance to clear

up.

See reversely

the uneven numbers ①, ③ and ⑤. All the

point of price is uptrend

They are more

likely optimist’s lines that they will happy for buying at the higher than

before price, regardless of higher price they are willing to collect them.

Find out

where it is from the chart. The level of price is getting higher and higher but

they don’t care of it, rather they are busy for collecting of them. In this

chart the winners are optimists who are don’t care of price. Hence This Patten

will guide you to the bullish.

Theoretically

descending pattern of triangle will be reversal not only shape of triangle but

also reaction of human psychology but the exception are inevitable

Let us

see the Descending triangle pattern as exception.

You may well

start to make it the trend from those 4 points depending from which the point

is breakthrough. Visualizing (a),(b), and(c) are breakthrough, how do you start

to draw the trend line?

Descending triangle pattern (3)

This is the other way around of ascending triangle pattern, even

meaning and storytelling

See the

uneven numbers, ①③⑤⑦ as the price is getting down, they are happy for selling it

See the even number ②, ④, ⑥ and⑧ they are happy for buying at same price of flat lines

Nevertheless

it is not guarantee that the price wills breakout the upper line of triangle. Do

not forget that we are talking about only probability but we are not talking

about sufficient and necessary condition on chart world.

Meanwhile

let us review the triangle I would like to give you some meaningful

information.

When it

is breakthrough within and inside of two third (2/3) (see at the place of No ⑧) or 70% of triangle, usually

it breakthrough upper line. It means the collector is arraying to rashness and reckless

Hence the

price should not go near to an apex of triangle

Wedge pattern (4)

This is distorted

as mutation as by all triangles Pattern, depending on your drawing pen.

You can use it, when the life cycle of stock is processing of collective wave such as 2, 4, and C wave and may well interpret it as a Symmetrical triangle pattern.

Hence we would better regard them as mutation of triangle. By and large all the Elliott pattern can be melting down into 3 Wedge pattern. The entire wedge is expression of retracement of wave against impulsion wave

Rectangle pattern (5)

This rectangle is one

of our main target place as right leg, intersected by the long feet in chair pattern,

no matter what retracements is (it should be 2 4 and C and E wave, as a form of

right or left toe)

you may consider long rectangle as process of period adjustment which I defined shortly the terms of “a feet” (refer to my chart pattern chapter)

you may consider long rectangle as process of period adjustment which I defined shortly the terms of “a feet” (refer to my chart pattern chapter)

It is power

balanced that 50% of them thinking that the price is cheaper at the certain points

Rest of them

(50%) think that the price is expensive at the certain points. At the same point it

is different opinion of valuation of it.

The

evaluations of stocks between bull and bear have been same quantity and quality

divided by exactly a half of them.

you may consider the movement of price is well balanced between buyer and seller, drawing rectangle.

you may consider the movement of price is well balanced between buyer and seller, drawing rectangle.

A Final winner,

driving like railway, is uncertain who is going to win until one of both is

derailed from parallel rail.

Such a

box can be substituted and displayed on the plot of BBS as pattern of sideway; we

regard it as same behavior and same psychology status of box theory. The power

balance, Comparing with triangle, between bull and bear has been exactly same

There are no converged to apex point which nearby an apex of triangle, the winner would be turn out.

I

strongly recommend you, if you are not professional, to deal nothing but this

Box theory, and strongly remind you to check whether if they have been passé though

the Saga of “C wave” or E wave as retracement (I name them feet and toe, refer

to chair pattern chapter). Like below picture, In this case I would bet upper

direction.

(a)

Is

rectangle after C wave as retracement ( defined a left feet)

(b)

Is

rectangle after E wave as retracement ( defined a right feet)

There are

two rectangle marked in yellow boxes.

Love this

pattern whatever they say of whipsaw patter rather does not afraid of it as

long as you are well armed with my 3 millers toolkits. This is our ambushing

place to hunt

It has

been frequently happened more than we expected. You may confront often enough with

this opportunity,

I wish you to have done for ready, and ready for hunting when you switched timeframe chart such as hours chart like 1,2,3,~12 hours as well as daily, weekly and even monthly chart.

I wish you to have done for ready, and ready for hunting when you switched timeframe chart such as hours chart like 1,2,3,~12 hours as well as daily, weekly and even monthly chart.

See ②④⑥ and ⑧

The entry

point is always the base (down) line of Box but not upper line of Box.

if you not depend on signal of stochastic divergence For sure, you have to arm with “stop lost” or “loss cut” base on the down lines of BBS (BBS and Box line of down line has same attribution of psychology)

if you not depend on signal of stochastic divergence For sure, you have to arm with “stop lost” or “loss cut” base on the down lines of BBS (BBS and Box line of down line has same attribution of psychology)

Yes! It

is called as the process of adjustment of period recharging the power but not

called as price adjustment. I define this as a feet (refer to my chair pattern)

You may

also deal this box not only with retracement but also with impulse wave such as

2 and 4 waves.

Meanwhile

the STOP LOSS is the Reversal divergence of Stochastic with 5 times multiple numbers chart. (For example if you see it by 25 minutes chart, you have to research the reversal divergence from 5 minute chart (5 minute chart X 5 times =25 minute chart)

you may be no big deal with 30 minute candle chart.) You never forget the LOSS CUT is only your savior in war of uncertainty.

the STOP LOSS is the Reversal divergence of Stochastic with 5 times multiple numbers chart. (For example if you see it by 25 minutes chart, you have to research the reversal divergence from 5 minute chart (5 minute chart X 5 times =25 minute chart)

you may be no big deal with 30 minute candle chart.) You never forget the LOSS CUT is only your savior in war of uncertainty.

Try to Do

your best to deal with The Best entry point of a toe, No ② if you get it at the base

line of rectangle.

As mentioned before, your psychology will be free from fluctuation between base and upper line.

If you are a professional, you may try to get it at the upper line as long as you conquer the Trio indicator conditions.( for its detail, refer to trio indicator chapter)

As mentioned before, your psychology will be free from fluctuation between base and upper line.

If you are a professional, you may try to get it at the upper line as long as you conquer the Trio indicator conditions.( for its detail, refer to trio indicator chapter)

It is one

of distinctively difference between Stock and Forex that Forex can offer you

the chance with bi-directions, “round trip” buying

and selling unlike stock, as long as you trust of the logic of Induction, but

stock is unfairly only one way.

And also

think about why after breakthrough the boundary of Box, the price is touch down

on the boundary of Box again?

And reflect on your statue of phycology, do you have any intention of ensuring profit, if you bought it on the pervious upper lines (let us say 4 times it has been touched) of box? Or keep going on it?

The ideal

entry point is the place of retracement, No ⑩ where is overlapped with middle line of BBS, Red

thick line shown by Telephone alarm signal(☎.) Which is

also same attribution as upper line of Box? (Remember! some say this movement

like whipsaw if so, the entry point is obvious)

Ladder (Channel) Pattern (6)

You may

know the entry point from Ladder (Channel) Pattern. Indeed! It looks like. If you have target on ②④⑥⑧ and⑩ you have right decision for buying but selling point is uneven mummers

①③⑤⑦

Regardless of those dealing points,

you can target on the “O” buying points from this pattern which is alternative

target point not only for saving the time but also for enhancing the possibility

of intersection with my 3 miller’s condition

Meanwhile

it may well be regarded as a distorted rectangle not only of characteristic behavior

but also of Psychological status. All Main concepts from the pattern are finding out common element by inductive logic, since all substance is same as rectangle pattern byproduct of Psychological war.

in especially ⑧&⑩ points are shared with resisted line of MAs and BBS, the more intersection of facts, the more you can ensure the better possibility

it may well be regarded as a distorted rectangle not only of characteristic behavior

but also of Psychological status. All Main concepts from the pattern are finding out common element by inductive logic, since all substance is same as rectangle pattern byproduct of Psychological war.

in especially ⑧&⑩ points are shared with resisted line of MAs and BBS, the more intersection of facts, the more you can ensure the better possibility

Flag pattern (7)

It is subtantilly same as other wedge patters.

we would better access to the lowest place not from Elliott

wave but other intersected facts such as here trede line(14) and 7(pillars)

because Elliott wave had been justfy himself with “differ with

circumstance.

Anyway

You may well regard the flag not only as one of a ladder pattern but also reactangle pattern

It is also happened to the process of retracement as well 2,4 and C as E wave like all other

pattern as difined left and right feet in chair pattern

Often enough the highiest top point (see the No ①) is shown

by a candle of grave stone, lightning rod or converted hammer type with higer

volume. At the same time if you check out stochstic, you may find out reversal

devergence.

However the important

thing from this pattern is to know where is best point to be entered.

It is also, Patience is a virtue, required the

processure of retracement with patience.

Without ignoring the post (finger sign ☞) as un- meaningful movement, you may have the worthy

to keep your eyes on it.

See the No ⑨ shown by Telephone alarm signal(☎.) which

is recoiled at the upper line of flag.

If you are using BBS as an indicator of your chart,

frequently we will see it’s replacement on the Red color think line of BBS

middle line. Hence whenever after breakthorugh is happed to all the pattern,

the Red line of BBS has intersected by the registance and supported line. Specially

in the peridod adjustmet of flag pattern, the the Red line of BBS has

fullifiled with strong supported line.

Converted Flag pattern (8)

It is subtantilly same as other wedge patters.

we would better access to the lowest place not from Elliott

wave but other intersected facts such as here trede line(14) and 7(pillars)

because Elliott wave had been justfy himself with “differ with

circumstance.

Anyway

You may well regard the flag not only as one of a ladder pattern but also reactangle pattern

It is also happened to the process of retracement as well 2,4 and C as E wave like all other

pattern as difined left and right feet in chair pattern

Often enough the highiest top point (see the No ①) is shown

by a candle of grave stone, lightning rod or converted hammer type with higer

volume. At the same time if you check out stochstic, you may find out reversal

devergence.

However the important

thing from this pattern is to know where is best point to be entered.

It is also, Patience is a virtue, required the

processure of retracement with patience.

Without ignoring the post (finger sign ☞) as un- meaningful movement, you may have the worthy

to keep your eyes on it.

See the No ⑨ shown by Telephone alarm signal(☎.) which

is recoiled at the upper line of flag.

If you are using BBS as an indicator of your chart,

frequently we will see it’s replacement on the Red color think line of BBS middle line.

whenever after breakthorugh is happed to all the pattern, the Red line of BBS has intersected by the registance and supported line.

Specially in the peridod adjustmet of flag pattern, the the Red line of BBS has fullifiled with strong supported line.

frequently we will see it’s replacement on the Red color think line of BBS middle line.

whenever after breakthorugh is happed to all the pattern, the Red line of BBS has intersected by the registance and supported line.

Specially in the peridod adjustmet of flag pattern, the the Red line of BBS has fullifiled with strong supported line.

Converted Flag pattern (8)

Nothing new on the sun except

rearrangement.

specially in the field of

stock analysis, there are too much copy and too much imitation of idea.

the diverged

exprestion of all the patern is just mutation of Eliliot wave, for instance,

calling contaminatedly the C wave as double bottom,W, dragon fly, and

butterfly, is substancely same thing, insisted noisely on that they created,

withoutconsidering of wherther if Readers

would paying for headache for acceptance of new terms or not. the difference is

just name. I am dying for remindding

them “Don't

reinvent the wheel”

It is ,for example, known not only by William J. O'Neil “CAN SLIM” “Cup with handle” American but also Gumajawa

Dakesaburo Japanese as totally same but just name is different even dow theory

it is called the “Neck line” it makes us toil and confusing.

The idea

is recalling a proverb” buy at the knee and sell at the shoulder” or “gives

cats the tail and head of fish” it means that lowest point is too danger to

trade it

And also it is known by the retracement of 2 or 4 wave of Elliott. Hence You may well consider it as one of category of feet or toe pattern but not you can hardly see that it is chair pattern.( because my chair pattern is the ending of C or E wave. But this is impulse wave)

① 2 wave of Elliott

Retracement of where is called “Cup with handle” by William J. O'Neil where is the

best point to be entered with weapon of Fibonacci. Can you find out where is

the handle? it is ① of telephone signal ☎ (I would

enter here as soon as the red middle line of BBS is set down)

② is

ending of ② wave of retracement shown by telephone signal for emergency

not to be forgotten nor confirmed by red line of uptrend.

③

Is the previous higher point. At the same time we

should remember the concise definition of “wave” which is defined as “when the

wave is simultaneously up both low and higher point, we call it ascending wave

or uptrend wave or wave is live. The other way around is downtrend wave. It

means that wave is about to start first step and overcome the bearish

phase.(read and chew and digest it

carefully and repeatedly )

From The rounded bottom or dish pattern,being good traders,

we have to smell as proffetional as that someone is sneaky and persistently

buying and collectring it.

Why?

Why do they do that?

We don’t need to know whom but but why?

we have to consider the course of facts and of why &

how:

they have the power enough to lift up price like big majors

they are able to enough preoccupate all the information

earirer than us

they have invested enough here with long plan and with

stragigic , unlike indivisutal players?

They are, Unless price is up, also losing money & time

like us, or are losing when they abonden it.

It is sufficient enough information for us to read their

cards from the cup with the handdle

Otherwise you have to re-suspect why they breakout the No③ of

priviouse higer point

Anyway

The length of bottom of cup is the longer, the better relatively.

It is also proposinal to it’s side way like reactandle thoey. It means the

collector’s money has been long time submerged into here, being charged energy,

and considering about Bank interrest, the collector has been so long time

crying and painful to be lingered by sleeping money ,Unless there are meaning

and otherwise they are misculcutlate it

.

W pattern (10)

This

scene is the chair pattern as left side. Observing 3 and 4 you may rejoice of stochastic

positive divergence.

Meanwhile

The Collectors (sponsor or majors) abhor and panic when the price is down less

than his purchasing price, being also human like us. For they are also slavers who

is subordinated by the psychology “preserving of original capital” or “retaining

prim cost”. They may deny they are not, but they are trading like us with unconsciousness

of cause and effect

The collators

or major or whomever we call them, they cannot deny neither be free from human.

It is common nature that all human can be upset when they are losing money. The

point is that as colleting stock, the price is not less than their purchasing

price

This

pattern is exactly “W” which the level of angle is “0” degree or flat

It means collectors

are panic when the price is lower than his breakeven price.

If you

are in his position, how do you feel it?

One day

the price is lower than your average purchasing price what do you feel like? It

is never useless question and never be wasted your time to be contemplated. For

example, I will say if you constantly or even sneakily have been collecting stock,

it means you have bought not stock but fear.

Let us

think in this way, in such case, there are two possibilities you can think:

One is happy case, if it is lower than your break-even price, you may celebrate yourself, because it is big chance to collect more of them. The other is stress case, if you have already invested, 80% of your whole asset “-“minuses which you cannot celebrate?

.

To make

it worse case, if the collector had approach to here with some secret or good

news about company, they will rash not to level down on No ② level of price,

Even they are eager to pay the price level of No ⑤

The case

of No ⑤, we

call it double bottom pattern. (Refer it to the double bottomed)

This is

my favorite pattern where we can fide the Eldorado.

See the

No ②. It is

almost “W” of flat

The

candle is called hammer type ( )

which as lower price tail (under shadow).

It means

the collector has defended this level of price.

Also see

the No ① as

well. In that time, the candle was hammer type with long tail (under shadow).

Majority or collector regarded it as that the level of ① and ② is reasonable in terms of stochastic

divergence

At the

same time, Remember the collector should not be always human being,

Nowadays computer automatically

buy it, when it is reached at the certain level. Where is beforehand programmed

If you approach to No ②, the stop loss is ideally

the divergence line No ④ between No ① ~ ②. You would better not keep eyes on the price

but the angle degree of stochastic. You may refer to the chapter of Stochastic.

However

you may call this as converted flag pattern

But you

may not forget what kind of psychology is melted into W pattern and dialogue

with even murmuring yourself as Candle’s movement

Double bottom W (11)

This is

ideal shape of my right leg and toe in chair definition and is an adjustment of

price as showing you deeper angle is rebounded from point of No ③.

They are

somewhat rush, rash and push themselves so as to collect it at the first and

one blow. Not processed in the name of ‘price adjustment’ for price.

④ is considerably

influenced by previous higher point who wants to keep at least break even price.

Hence it will be logical conclusion that the result of ④ is production of

prevailing negative phycology from previous price of higher point

Also No ④

is the point where you may draw the Fibonacci adjustment by the tool of Fibonacci

retracement, which would measure collators’ willingness

26>38>50>63%. If it is retracement

by no lower than 63%, we should let them go and forget it. Because the

definition of Wave could not accordance with

From time

to time when you face with circumstance, always create some “resistance & supported

line where is concurrent with my 3 miller condition not to mention with other intersectional

point, you will be a huge beneficiary, thought, It

differ in circumstance.

For example

in this circumstance if you, at this moment able to think and create “Fibonacci

retracement supported line; it is just in time you have thought and created it

VVV pattern (13)

This is

ideal right leg but feet which are ideal rectangle as C wave or down- trend of

Flag patter as period adjustment.( some say it is whipsaw) Whatever it flat forms as box and rectangle

shape unlike ‘V’ pattern. It is the toe but long feet of right side, in modeling

of charging the energy just like charging your mobile phone battery.

As I mention

as earlier as rectangle pattern, it is more significant and powerful when it is

happened after C wave (Refer back to Rectangle pattern (5))

Insinuating

and tantalizing and Showing you this process of ‘the period adjustment’, the major

are sucking your blood like vampire with Ringer's solution (perhaps this is one of reason why people dedicate

conning a word “a whipsaw’ pattern)

The

length of rectangle is proportional to power of major, which mean that major

has power to control enough all the stock and energy enough to lift up the

price, entirely depending on major’s merci. It is often occurred not only at

the chair pattern as long feet but also at the any retracement wave such as 2

or 4 wave.

When

and where is the ideal timing point to enter?

It

is time when “three Moving average” (for example 5, 20, and 60MA) is converging

into certain point, inside of rectangle. It has more meaningful, sticking

together at a point at least 3, (of course the more, the better) and fortunately

you can find out in this chart “3 three Moving average” such as (5, 20, and

60MA) and also you can check it out; such as the purple, yellow and green color

MA. (I know it is not exactly but more or less, they have been converted into Box.)

It is also

called as three bottoms and bottom of dish of ‘Cup with handle’ even you may

call it as Converted Flag pattern.

Be my guest, the calling is not important as much as it is true meaning. But we have to try deciphering what nature they have, since trading is not so much Quiz show as it is dried war with logic and reason

Hence we are faced with requirement of knowing what kind of reaction will be expected and predicted from the entire pattern. Since our study is not matter of memorizing all the pattern and name.

Be my guest, the calling is not important as much as it is true meaning. But we have to try deciphering what nature they have, since trading is not so much Quiz show as it is dried war with logic and reason

Hence we are faced with requirement of knowing what kind of reaction will be expected and predicted from the entire pattern. Since our study is not matter of memorizing all the pattern and name.

Dish pattern (14)

①

Is

meaningful line for resistance and supporting line

②

Is

hammered by 1,due not to breaking through the previous lower point

③

Is

ideal point for the Cup with handle or (the Neck line) which is acted as both resistance

and supporting line. Usually the volume if you can see is higher than 2 when 3

breakout 2 and 1. But interestingly seconded time of rising candle is inverted propositional

volume. I mean when the point of 3 is rising up, the volume is lower than 2. But

price is UP!

The

expected price is not only the dish pattern but also is lowest point.

Only this

pattern seems to have less relation with Finger theory, being able to hardly discover

any fragment of waves from here. Rather it seems to be as whole of life cycle

of Elliott wave.

It is considerably depending on between macro and micro view in terms of timeframe. at any rate you can draw the expected price line according as previous higher point as a rule of balance see the both level of = and =

It is considerably depending on between macro and micro view in terms of timeframe. at any rate you can draw the expected price line according as previous higher point as a rule of balance see the both level of = and =

Meanwhile

think about the definition of a line in basic geometry, “A straight line is the

shortest distance between any two points on a plane.” the circle and line are

both same “Line is shortest distance linked between any two points.” But point itself

is circle, increasing, zooming in the point.

Accordingly

if it is 5 minute, it obviously seems to be a dish or cup or rounded bottom. If

it is weekly chart, it is more likely just a point of weekly candle like this

type of candle

Accordingly our life time is just dayfly time of weekly chart

You may expend the idea into philosophy, late on (things has relatively

unequal value from time and place) such as the mutations of morals and manners, the masterpieces of literature,

the development of

science, and the achievements of art, and so on. It may be wise; having all value is changeable, in terms

of candle chart.

It may be unwise to put rashly and bravely

off the judgment for something or anything without zooming in/out as well as the different

timeframe chart.

We can approach

to here not by Macro view (on large scale) but by micro view, interpreting that

dish pattern is integrated by fragment of the entire pattern which you have

been study so far. And also we need to be understood that a dish or cup pattern

is imperceptible as whole but as part, after sectioning each pattern.

This

pattern have provided with useful information not only for approaching to William

J. O'Neil “Cup

with handle” technical point but also useful information

of recognizing that majors is sneakily collecting them with long term plan and strategic.

Meanwhile

regarding about volume indicator, it is nature that the volume is gradually increasing

on this point , even better if we can achieve the positive divergence from it,

whereas the buying point is lowest volume , which means that the major has been

successfully accumulate enough to rise up the price for there are no more overhead

supply.

Welding for 3 wedges

Wedge

has, somewhat, same nature with dish pattern in term of timeframe view.

We can

enjoy for juggling 3 wedges and above dish pattern with dissection and section

from the entire shape

We can

also similarly weld 3 wedges so as to rebuild Elliott wave with the entire segment

of them which we have discoursed.

For example

Cutting

ripples of wave, and considering that

the lowest points as someone sneakily and steadily collecting stocks like dish

pattern from those standard of Elliott wave, we can find out same as converted original

five fingers as shape of wedge, having no objection against all the trader

including major are always trying to ensure maximums the profit from their business.

Hence the minimum of their expense is same lowest point of the apex of wedge

and of dish.

Convertibly,

you can create your own view of Elliott wave and interpret all pattern as shape

of wedge even pattern and even you can write a book from this issue.

Hence

If those

14 components as factors are supposed to be jointed or welded by Elliott wave, perhaps

by all wedge patterns if you insist on.

Then the

Elliott wave should be, by all accounts, dismembered

all the fragments of those 14 components of “traditional trend line” which we

are marching for dissecting those Elliott wave.

The entry

point is intersected by both wedge of and of “^” signal

Not to do

losing money from trading is to find out the wedge pattern and reorganize its

proper time and proper response with your own interpretation and adaption restlessly

with the ideal thought way of your induction and deduction. Perhaps this is all

about not to be loser from the battle.

The 3

wedge are elements of Elliott wave to be destroyed and built repeatedly and Demolished

and re construct with the five fingers from 7 pillars of my pattern.

It is

just like childish game, finding out the piece of Puzzle and reconstructs same

shape of your hands. Though it is not easy for grow man but Kids are better

than you, Untamed by the fear and greedy. We can be one of them, being able to

find out those wedges and control fear and greedy.

Perhaps this

game is not for you but for the both of Kids and Wiseman.

So 95%

traders is crying but lest of them, just 5% is saying “life is beautiful” because

only 5% of them have been granted as saying that what is life

See the

No ③ specially

inside of circle, long shadow tail and rebounded as black swan since then. You can

call it as C wave as well as descending wedge. Can you create the shape of

Wedge? If so how many more of wedges can you draw and adorn on the chart?

If you

garnish wedge pattern more than 20 shape, so for so good, I think you totally

understand what I wanted to say.

You may

well interpret it as not only Symmetrical triangle pattern and other of all triangle

Patterns such as ascending, deseeding and right angle and the entire triangle

should be deformity by Wedge pattern.

We are

hunters to catch the lowest price of chart.

According

to Dow Jons and Elliott, they tirelessly reported the place where we have be

bumming around., we recognize, digesting of them ,that it is synonym; to hunt

them is to find out “C” wave.

After another

digesting the first digesting one which is what they said, is that it is synonym

to find out 3 wedge pattern.

We are

apt to invent for some pattern with heroism but “Don't reinvent the wheel” it

is all come from Elliott wave. Remember that the dissection of Elliott is the welding

of wedge pattern

What else

of the piece of shape do we can expect from such fluctuation, up and down?

The above

shapes are typical wedge but it can be mostly deformed. It may be big help for

you to play imaginably a juggling for a while with those wedge shape.

You may

also deal this box not only with retracement but also with impulse wave such as

2 and 4 waves, you may Use those wedge pattern with a fact, very useful fact,

which a rectangle is seldom happening 2 times in life cycle of wave.

This information

is almost a savior from chaotic chart for analysis

Rectangle

is never happened two times in life cycle of Elliott wave, but only 1 time.

It can be

interchange between 2 and 4 waves, In the process of corrective or retracement

as life cycle.

For

example if you are dealing with Box in this time, you may expect that next retracement

is not box. If you are dealing with wedge, you may expect that next is box. Approaching

with this clue to your box target you may achieve a good navigator for Journey

Ocean in chaotic waves

Having 3 bullets

as 3 wedges, Good sniper should not waist his bullet for shooting with 3 wedges

to bull’s-eyes

Where are

bull’s eyes?

Watch out

⑨ and think

about why it is acted as ideal point for entering and think about what the

volume is supposed to be if you remember the dish pattern.

Can you

make a draw of butterfly and why?

You can approach

this concept into fractal geometric

This strategic

is intersected both by cup with handle and with rebounding point of

Macro

view it can be draw big wedges with thicken deep blue line such as ① ② and ④

See the

No④ ~② and also⑤ ~ ③.

To know

that place is to find out where are 3 bullets, let us see the No ①, ②

and No ③.

Inside of

big wedge there are 3 wedge patterns. Please refer to wedge pattern more

detail.

It is composite

with

More

detail about those wedge pattern, you may well see the Pattern chapter.

Contrasting

between regular and irregular pattern, they are difference.

According

to Elliott wave, C wave is same level or no less than bottom of 4 waves

4 waves

is same level or no less than bottom of 1 wave

Hence

C wave

≧ 4 wave ≧ C wave.

Affected by the (expression of) inequality

about Wave theory, we call it regular. The other way around is irregular

pattern

It is oddly

enough that such a so many gracious excuse and obscurity has been so many creating

the job and saving us from not being unemployed.

Some

leaders may fly into a rage like Socrates say,

-“What is

it”, and define your terms if you want to do conversation with me, why they are

so many exceptional rules and how many times they are differing with

circumstance,- thinking whether if we have sufficient enough time for bumming

around?”

By all

mean!

I make

you for sure that it is doubtlessly better known than not know. It will be

meaningful enough after combination with other circumstance and with all the

facts which consequently I am going to illuminate

The

entire players would be confronted with status of “A drowning man will catch at

a straw. Catching this Elliott wave, you have caught not a straw but big

Styrofoam so as to float enough by yourself for survival game from countless danger

of ocean, since there is no absolutely rule but there are absolutely unpredictable

game as drunken walking in the stock market.

Even

though if you ask me what kind of character will be matched up this game? Seemingly

it will be more useful job for the German than for the French people, heard

that stock is total art.

In one aspect,

Germany People will mourn for when Elliott and his theory is dead and science, too.

But the French will rejoice, seeing it as spice life when anything can be being

formalized by Germany, anymore.

Going further,

you will recognize how we are hunting for lowered price with 3 wedges as alteration

of C wave

Critique

As matter of fact

in real trading and real battle, I can hardly guarantee you that you are well equipment

or properly armed both with the trend line of geological pattern and with

conception of resistance & supported lines. Both ball, (7 pillars and 14

patters) been now and then and perhaps forever parasite on one of sufficient condition

of our destination; For there are no absolutely rules that those lines must be

consisted of beelines and curves, and must be displayed on chart only by

straight line, we need to adopt the curve lines as intersection of both ideas

of two balls

Hence it would be

flexible, probable and rational idea

for us to adapt both the curve and straight line as resistance and supported lines for ensuring

high probability since all anlysist presumably have complain and unsatisfied

with beeline. Perhaps this is reason why they have to develop the sophisticated

detail of trend line as curve such as MA BBS and envelop chart indicator for channel

conception.

For sure whenever

you see geological patterns for example when you see in bullish phase, one of

them; the Symmetrical triangle pattern (1) Ascending triangle pattern (2) Wedge

pattern (4) Rectangle pattern (5) and so on, we may take a better stance with higher

probability, preparing to sell it, because it is a preordain pattern after ascending

wave, convertibly, we may take a better stance to buy it after descending wave.

For example

when you see the Rectangle pattern in bluish phase(5 wave) we need to ready for

selling it; because it is not only prearrangement wave, deseeding after assenting, but also it is in common place where are the related reasons intersected by such as the double

top, head and shoulder and negative divergence. It must be conservative strategic

to execute after checking the direction. I heard (warren buffet) doing same

thing “come down the right side of the fence” not only the Rectangle pattern

but also all other pattern as well

Hence We

should not falling in predilection rather should keep eye on those two ball;

for 7 pillars and 14 trend lines; for it is not guarantee the lower points but justify

and abuse the pretext to be pardon and it does not meaning that one of those sufficient

is always waiting for only your eyes, having to be ready at any moment for compensating

yours opportunity cost, rather it is required from your discretion especially

in which place is happened.

Anyway both can

be integrated by Elliott wave and all those ideas are converged into the conception

of Elliott wave as well as the theory of trend. In one aspect, both conception

of convergence and divergence, in the game of trading, are key words Even

Elliott wave is divergence into the process of Caesarean section 7 pillars and

14 traditional trend lines and convergence into the process of hymen

reconstruction surgery as convergence of facts which is contracted by all the

reason of theorem with convergence

It seems to be any process of sentence should

be variably diffused into its all the

reason of theorem into divergence, such

as transforming or dissecting from

Elliott wave into wedge pattern, interlink with 7 pillars with diverse reason

on every corner of every single concurrent place to be chew. We shall precede

those two balls for the convergence into the process of hymen reconstruction

surgery into its original shape of Elliott wave.